For life

Life Assurance is all about putting your loved ones first. Our cover provides financial refuge in times of hardship and offers stability in their lifestyle, even when you’re gone.

Whole of Life We’ll pay a lump sum amount to your beneficiaries when you pass on. Accidental Death Cover When you pass on after an accident, we will pay a lump sum amount to your beneficiaries. Term Cover Take up a life cover for at least 10 years to protect your loved ones from any financial risks within the period of of your cover.

Our partners are the leading life insurance companies, general insurance companies and composite insurers in the industry to ensure that a wide breadth of products and services are available for our consumers and customer satisfaction and service is met especially during the management and claims process.

Against fire

Fire Insurance provides protection against loss in the event of a fire. This insurance policy covers loss or damage to property caused by fire, lightning, explosion, earthquake, bush fire, riot and related perils.

A Fire policy (basic cover) will provide cover for damage or destruction to insured property by Fire, lightning or explosion of domestic appliances. The Fire & perils is an extension of the basic cover and will extend to include the following additional covers:-

- Riot & Strike

- malicious damage

- Explosion

- Special Perils (water perils of flood, blocked drains etc)

- Earthquake

- Bush Fire etc.

For travel

The increase in international travel has meant that risks associated with it have grown. This coupled with the high cost of medical care abroad has made travel insurance vital for any traveller. Travel Insurance through The Heritage Insurance Traveller provides 24 hours emergency and medical assistance anywhere in the world. You can enjoy easy and carefree international travel. The Heritage Traveller is also accepted by countries that require travel insurance before issuing visa.

Some of the benefits you will enjoy with The Heritage Traveller include:

- Travel delay / Flight cancelation

- Medical and emergency expenses

- Hospital allowance

- personal accident

- Personal Liability

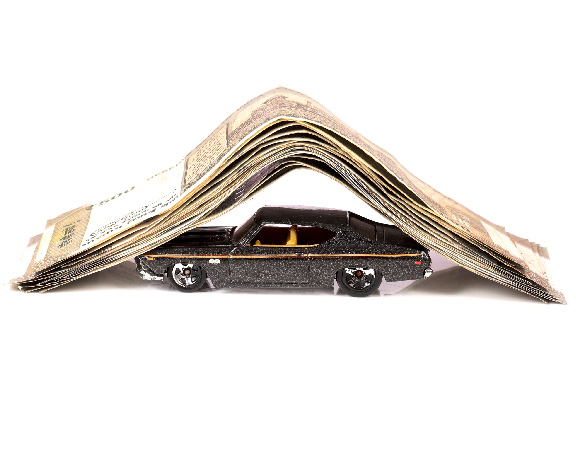

For a car

Car insurance ensures that you do not suffer a setback financially in case of an accident. But remember, it is not a one-size-fits-all requirement. Choose the most suitable plan for you and include the benefits that you would like to have. It is also a legal requirement to have car insurance in Kenya.

Repair or replace vehicle or its parts in case of loss or damage and cover 3rd party legal liability

Repair or replace vehicle or its parts in case of loss or damage and cover 3rd party legal liability

Our partners